The Diponegoro International Capital Market Investment Challenge (DINAMIC) is a prestigious event series within the Diponegoro Capital Market Days (DCMD), hosted by the KSPM FEB Universitas Diponegoro. As its name suggests, DINAMIC serves as a platform for undergraduate and diploma students to demonstrate their analytical and strategic expertise through comprehensive equity research and in-depth stock valuations.

Participants must provide BUY, HOLD, or SELL recommendations for publicly traded companies across multiple stock exchanges. The challenge spans a diverse range of markets, including the Indonesia Stock Exchange (IDX) and leading global exchanges such as the New York Stock Exchange (NYSE), NASDAQ, Hong Kong Stock Exchange (HKEX), Shanghai Stock Exchange (SSE), and Tokyo Stock Exchange (TSE). Additionally, the challenge incorporates key Southeast Asian exchanges, including the Singapore Exchange (SGX), Bursa Malaysia (MYX), The Stock Exchange of Thailand (SET), The Philippine Stock Exchange (PSE), and Ho Chi Minh City Stock Exchange (HOSE), equipping participants swith a comprehensive understanding of both regional and global capital markets.

By participating in DINAMIC, participants are expected to enhance their critical thinking abilities, gain a deeper understanding of both regional and global capital markets, and refine their skills in making data-driven investment decisions.

Your Opportunity Awaits:

Join DINAMIC Now!

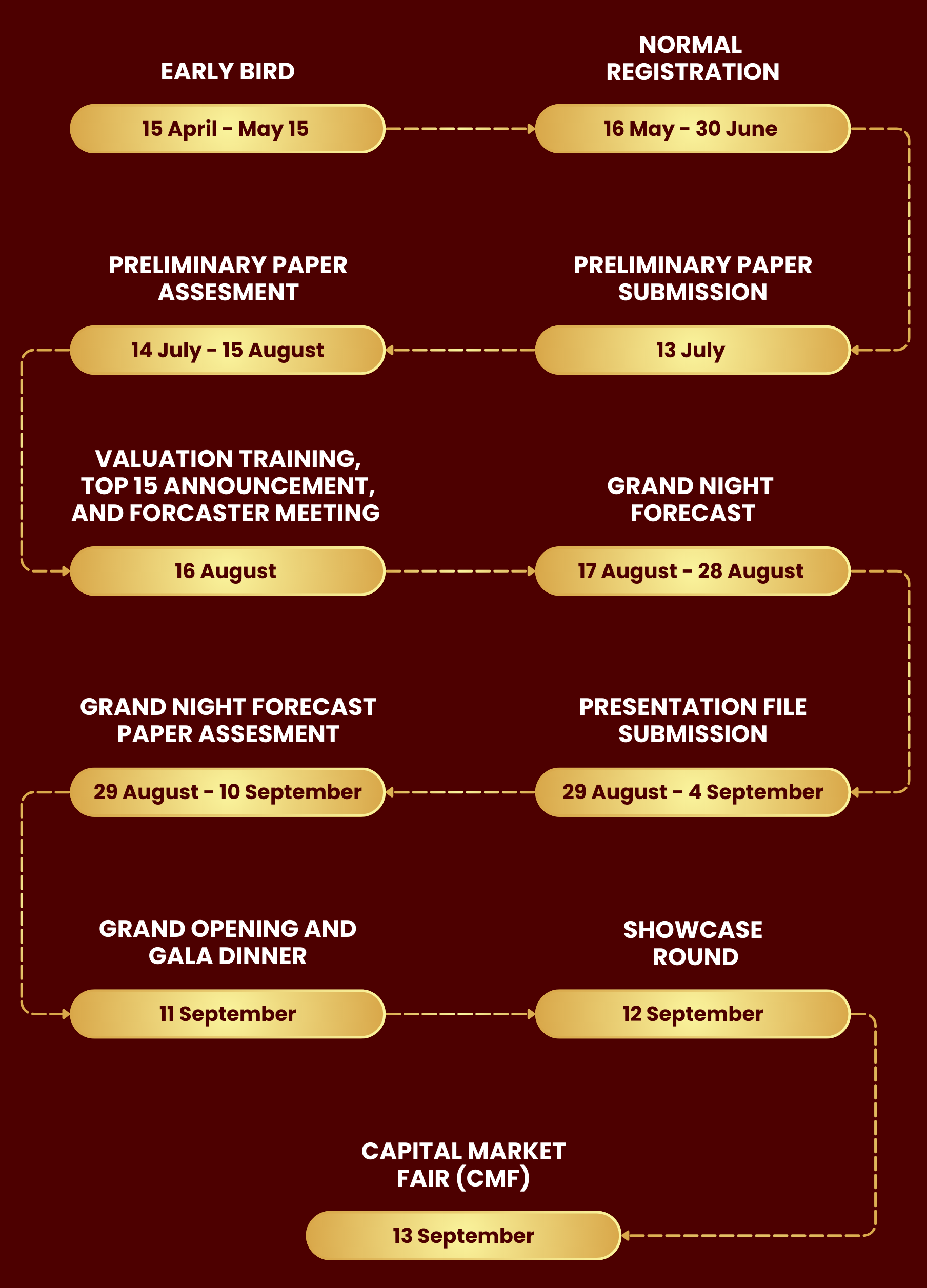

DINAMIC TIMELINE

PAST PARTICIPANT

DINAMIC THEME

"Indonesia's Infrastructure Boom: Investment Opportunities in Mega Projects"

Indonesia is at a crucial transition point toward Indonesia Emas 2045, a grand vision that can only be realized through robust infrastructure development and sustainable economic growth. However, amid this ambitious goal, significant challenges persist—limited access to homeownership, regional development disparities, and constrained funding for strategic infrastructure projects. History has shown that developed nations are built on strong infrastructure foundations, and Indonesia must not fall behind. A well-planned investment strategy, thorough risk assessment, and optimal capital utilization are essential to ensure that these large-scale projects can serve as the driving force of economic growth.

In this context, the role of investors becomes critical in driving strategic investments that can accelerate the development of national mega projects. Therefore, the theme “Indonesia’s Infrastructure Boom: Investment Opportunities in Mega Projects” serves as a call for young investors to explore investment opportunities in the property, real estate, and infrastructure sectors. Through fundamental and technical analysis, participants are expected to uncover the sector’s growth potential and understand how the right investments can act as a catalyst for national economic development, paving the way for Indonesia Emas 2045.